Anyone veterans benefit overview: what to know

Anyone veterans benefit overview outlines crucial insights on benefits available to veterans, shining a light on key resources they deserve.

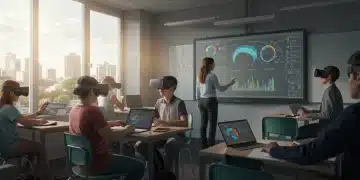

Political digital classroom best practices for engagement

Political digital classroom best practices can enhance student engagement and learning outcomes. Explore effective strategies here.

Quickly press freedom watch: how it impacts you

Quickly press freedom watch reveals important insights on media and democracy, urging readers to stay informed.

Before pandemic relief continuation: what lies ahead?

Before pandemic relief continuation insights reveal crucial steps for securing financial stability. Discover key strategies now!

Any public school improvement: strategies for success

Any public school improvement can transform education. Discover effective strategies that can create positive change in schools today.

Large government cash aid: Your essential guide

Large government cash aid can support many in need. Discover options and make informed choices today!