COBRA Benefits 2025: Expert Guide to 18-Month Healthcare

Navigating COBRA benefits 2025 is essential for individuals needing to extend their health insurance after specific life changes, providing a critical temporary safeguard for continuous healthcare access.

Losing employer-sponsored health insurance can be a daunting prospect, but understanding COBRA benefits 2025 offers a crucial pathway to maintaining your coverage. This expert guide delves into how the Consolidated Omnibus Budget Reconciliation Act (COBRA) provides a temporary extension of group health coverage for up to 18 months, offering peace of mind during significant life transitions.

What exactly is COBRA and why is it essential in 2025?

COBRA, standing for the Consolidated Omnibus Budget Reconciliation Act, is a federal law that allows certain employees and their families to continue their health benefits for a limited time after a job loss or other qualifying events. It’s not a new insurance plan, but rather an extension of your existing employer-sponsored group health plan.

In 2025, COBRA remains a critical safety net, particularly in an evolving economic landscape where job changes can occur unexpectedly. It bridges the gap between losing your old coverage and securing new insurance, ensuring you and your dependents don’t face a lapse in vital medical protection.

Key qualifying events for COBRA eligibility

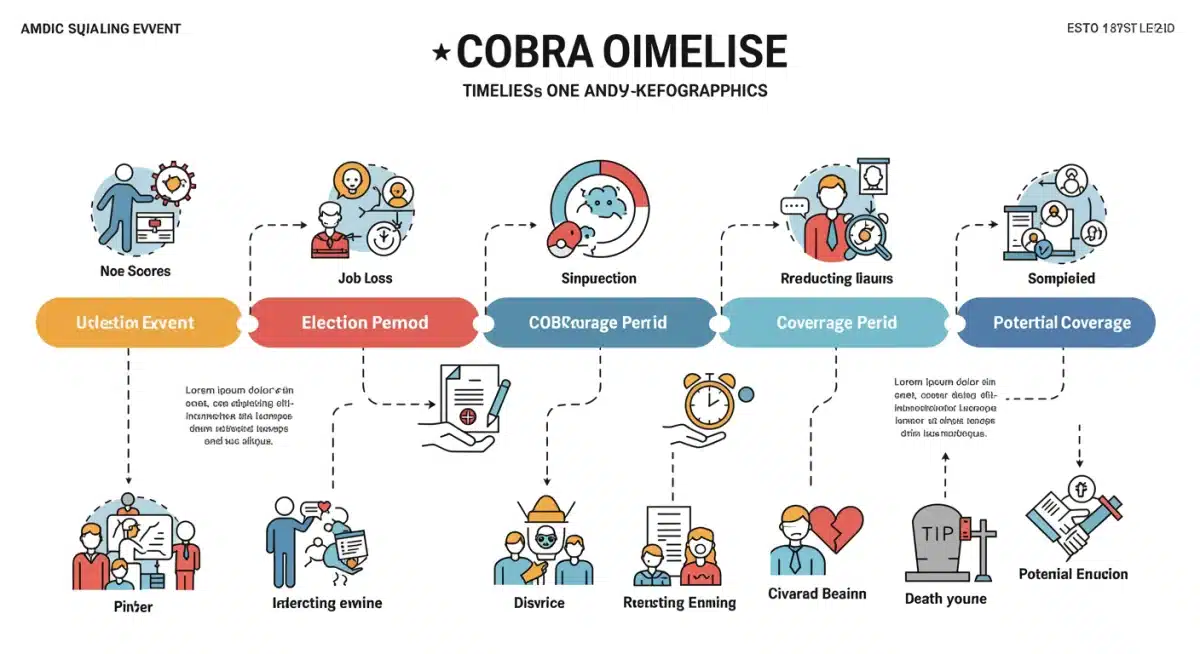

Eligibility for COBRA hinges on specific ‘qualifying events’ that lead to a loss of group health coverage. These events are clearly defined by law to ensure fair access to continued benefits.

- Voluntary or involuntary termination of employment (for reasons other than gross misconduct).

- Reduction in the number of hours of employment.

- Death of the covered employee.

- Divorce or legal separation from the covered employee.

- A covered employee becoming entitled to Medicare.

- A child’s loss of dependent status under the plan rules.

Understanding these events is the first step in determining if you or your family members qualify for COBRA coverage. Each scenario triggers a specific timeline for notification and election, which is crucial for maintaining eligibility.

COBRA’s role in 2025 extends beyond just employment changes. It also provides coverage continuity for families facing significant life events, ensuring that medical needs can still be met without immediate financial strain. This makes it an indispensable component of the U.S. healthcare system, offering stability during times of uncertainty.

Who is eligible for COBRA benefits in 2025?

Determining COBRA eligibility involves several factors, primarily revolving around the type of employer, the nature of the qualifying event, and your status as a covered employee or beneficiary. Not all employers are required to offer COBRA, and not all individuals who lose coverage are eligible.

Generally, COBRA applies to group health plans maintained by private-sector employers with 20 or more employees on more than 50% of its typical business days in the previous calendar year. State and local governments also fall under COBRA. Therefore, if you worked for a smaller employer, you might need to look into state-specific continuation coverage laws, often referred to as ‘mini-COBRA’ laws.

Covered individuals and their roles

COBRA isn’t just for the employee; it extends to various covered individuals who were part of the group health plan. This broadens the safety net significantly.

- Covered Employees: Individuals who were enrolled in the employer’s group health plan on the day before the qualifying event.

- Spouses: The spouse of a covered employee, if they were covered under the plan.

- Dependent Children: Children who were covered under the plan as dependents of the employee.

Each of these individuals has their own right to elect COBRA coverage, even if the primary employee chooses not to. This is particularly important in situations like divorce or a child aging out of dependent status, where the employee might still be employed but other family members lose coverage.

Understanding who is eligible is crucial for making informed decisions about your healthcare future. It ensures that no one who qualifies misses out on the opportunity to maintain their health insurance during a transitional period.

The duration of COBRA coverage: up to 18 months and beyond

One of the most frequently asked questions about COBRA is how long the coverage lasts. The standard maximum duration for COBRA continuation coverage is 18 months. This period applies to qualifying events like termination of employment or reduction in hours.

However, it’s important to note that this 18-month period can be extended under specific circumstances. Certain qualifying events, or a second qualifying event occurring during the initial 18-month period, can lead to extended coverage.

Extensions and secondary qualifying events

While 18 months is the norm, some situations allow for longer periods of COBRA coverage, providing additional security.

- Disability Extension: If a qualified beneficiary is determined by the Social Security Administration (SSA) to be disabled at any time during the first 60 days of COBRA coverage, they may be eligible for an 11-month extension, totaling 29 months of coverage.

- Second Qualifying Event: If a second qualifying event (like divorce or a child aging out) occurs during the initial 18-month period, coverage can be extended to a maximum of 36 months from the original qualifying event.

These extensions are not automatic and require proper notification to the plan administrator. Missing deadlines can result in the loss of these extended coverage options. Therefore, beneficiaries must be proactive in communicating any changes in their status to ensure they receive the full benefits they are entitled to.

The flexibility of COBRA, with its potential for extensions, underscores its value as a temporary bridge for healthcare. It allows individuals and families to navigate significant life changes, including health challenges, without the added burden of losing medical insurance.

Understanding COBRA costs and payment in 2025

While COBRA offers invaluable continuity of coverage, it’s often more expensive than the employer-sponsored plan you had previously. This is because, under COBRA, you are typically responsible for paying the full premium, plus an administrative fee.

Employers usually cover a significant portion of their employees’ health insurance premiums. Once you elect COBRA, you take on that entire cost, which can be a substantial financial burden. In 2025, as healthcare costs continue to rise, budgeting for COBRA premiums will be a critical consideration for many.

Calculating your COBRA premium

The cost of COBRA is determined by your former employer’s group health plan. Generally, you can expect to pay up to 102% of the total cost of the premium. This includes both the portion the employer used to pay and the portion you paid as an employee, plus a 2% administrative fee.

It’s important to ask your former employer for an accurate quote of the COBRA premium as soon as you receive your election notice. This will allow you to compare it with other healthcare options available, such as plans through the Health Insurance Marketplace.

Payment deadlines and consequences of non-payment

COBRA payments typically follow a strict schedule. After electing COBRA, you usually have an initial grace period (at least 45 days) to make your first premium payment. Subsequent payments are generally due on the first day of each coverage month, with a 30-day grace period.

Missing a payment, even by a day, can result in the termination of your COBRA coverage. Once terminated for non-payment, reinstatement is often not possible. Therefore, setting up automatic payments or carefully tracking due dates is essential to avoid an unexpected loss of coverage.

The financial aspect of COBRA is often the most challenging, but its benefit of maintaining continuous coverage, especially for those with ongoing medical needs, often outweighs the cost for many individuals and families.

The COBRA election process: timely decisions are key

The process of electing COBRA coverage is time-sensitive and requires careful attention to detail. After a qualifying event, your plan administrator has a specific timeframe to provide you with an election notice. This notice contains crucial information about your rights, the cost of coverage, and the deadline for making your election.

Typically, you have at least 60 days from the date you receive the election notice (or the date your coverage would terminate, whichever is later) to decide whether to elect COBRA. This 60-day window is non-negotiable; missing it means you forfeit your right to COBRA coverage.

Steps for electing COBRA coverage

Navigating the election process efficiently ensures you secure your healthcare safety net without unnecessary delays.

- Receive the Election Notice: Your employer or plan administrator is responsible for sending this notice after a qualifying event.

- Review All Information: Carefully read the notice, paying close attention to the coverage options, costs, and deadlines.

- Compare Options: Evaluate COBRA against other alternatives like Health Insurance Marketplace plans, Medicaid, or a spouse’s plan.

- Submit Your Election: Complete and return the election form by the specified deadline. Keep a copy for your records.

- Make Your First Payment: Ensure your initial premium payment is made within the grace period to activate your coverage.

It’s vital to communicate any questions or concerns directly with your plan administrator. They are the primary source of accurate information regarding your specific COBRA options and deadlines. Proactive engagement can prevent costly mistakes and ensure a smooth transition of your healthcare benefits.

Making a timely and informed decision about COBRA is paramount. It allows you to maintain continuous healthcare coverage, protecting you and your family from unexpected medical expenses during a period of transition.

Alternatives to COBRA in 2025: exploring other healthcare options

While COBRA offers a valuable continuation of employer-sponsored health insurance, it’s not always the most affordable or suitable option for everyone. In 2025, a range of alternative healthcare coverage options are available, and it’s essential to explore these to find the best fit for your circumstances.

The cost of COBRA can be a significant deterrent, as you bear the full premium plus an administrative fee. For many, especially those facing job loss, this expense can be prohibitive. Fortunately, other avenues exist to secure health coverage.

Key alternatives to consider

Exploring these options can lead to more affordable or better-suited coverage than COBRA.

- Health Insurance Marketplace: Losing job-based coverage is a qualifying life event that opens a Special Enrollment Period (SEP) on the Health Insurance Marketplace (Healthcare.gov). You can compare plans and potentially qualify for subsidies that lower your monthly premiums.

- Medicaid: If your income falls below a certain threshold, you might be eligible for Medicaid, a joint federal and state program that provides free or low-cost health coverage.

- Spouse’s Employer Plan: If your spouse has employer-sponsored health insurance, losing your coverage is usually a qualifying event that allows you to enroll in their plan.

- Short-Term Health Insurance: These plans offer temporary coverage but typically don’t cover pre-existing conditions and are not ACA-compliant. They are generally not recommended as a long-term solution.

- Direct Enrollment with an Insurer: Some insurance companies offer individual plans directly outside the Marketplace.

It’s highly recommended to compare COBRA costs and benefits with plans available through the Health Insurance Marketplace. The Marketplace can often provide more affordable options, especially if you qualify for premium tax credits or cost-sharing reductions based on your income.

Evaluating all available alternatives is a crucial step in ensuring you maintain comprehensive and affordable health coverage in 2025, tailored to your financial situation and medical needs.

Insider knowledge: strategic tips for managing COBRA in 2025

Navigating COBRA can feel complex, but with some insider knowledge, you can make more strategic decisions about your healthcare continuity. Beyond the basic eligibility and cost considerations, there are nuanced approaches that can optimize your use of COBRA benefits in 2025.

One critical tip is to consider COBRA as a bridge, not necessarily a destination. While it provides continuity, its cost often makes it a temporary solution. Therefore, simultaneously exploring other options during your COBRA election period is a savvy move.

Practical strategies for smart COBRA management

Applying these strategies can help you manage your COBRA coverage effectively and efficiently.

- Delay Election (Strategically): You have 60 days to elect COBRA. If you’re healthy and don’t anticipate immediate medical needs, you can technically delay your election and only elect retroactively if an unexpected medical event occurs within that 60-day window. However, you’d be responsible for all back premiums. This is a high-risk strategy and should be considered carefully.

- Coordinate with Marketplace Enrollment: Use your COBRA election period to thoroughly research and apply for plans on the Health Insurance Marketplace. The Special Enrollment Period lasts 60 days from the loss of coverage, aligning with your COBRA decision window.

- Understand State ‘Mini-COBRA’ Laws: If your former employer has fewer than 20 employees, federal COBRA might not apply. Research your state’s mini-COBRA laws, which often provide similar continuation rights for smaller employers.

- Leverage the Medicare Entitlement Rule: If you or a covered family member becomes entitled to Medicare while covered by COBRA, it can be a second qualifying event, potentially extending coverage for other family members up to 36 months.

Another often-overlooked aspect is the importance of clear communication with your former employer’s HR department or plan administrator. They are your primary resource for accurate information about your specific plan details, deadlines, and any potential extensions. Document all communications.

By adopting these strategic tips, you can transform the challenge of losing employer-sponsored health insurance into a well-managed transition, ensuring your healthcare needs are met without undue stress or financial surprises in 2025.

| Key Aspect | Brief Description |

|---|---|

| Eligibility | Applies to employers with 20+ employees; triggered by qualifying events like job loss. |

| Coverage Duration | Standard 18 months, extendable to 29 or 36 months under specific conditions. |

| Cost | Beneficiary pays 100% of premium + 2% administrative fee. |

| Election Period | 60 days from notice or loss of coverage to elect; strict payment deadlines apply. |

Frequently asked questions about COBRA benefits in 2025

Yes, voluntary termination of employment is generally a qualifying event for COBRA, as long as it’s not due to gross misconduct. You will still have the option to elect continuation of your health coverage for the standard 18-month period, provided your employer meets COBRA requirements.

Not necessarily. While COBRA provides continuity, it can be expensive. It’s crucial to compare COBRA costs with plans available on the Health Insurance Marketplace, which may offer subsidies, or other options like Medicaid or a spouse’s plan, to find the most affordable and suitable coverage for your needs.

Missing the 60-day COBRA election deadline typically means you forfeit your right to elect COBRA coverage. It’s a strict deadline with very few exceptions. Therefore, it’s vital to act promptly and submit your election form within the specified timeframe to avoid losing this valuable option.

Yes, each qualified beneficiary (employee, spouse, dependent child) has an independent right to elect COBRA coverage. This means your spouse or children can choose to continue coverage even if you, as the former employee, decide not to, ensuring their healthcare needs are still met.

Currently, there are no general government subsidies for COBRA premiums like those available on the Health Insurance Marketplace. Past subsidies, such as those during the COVID-19 pandemic, were temporary. You would be responsible for the full cost of the premium plus an administrative fee.

Conclusion

Navigating the complexities of healthcare coverage in periods of transition is a significant challenge for many Americans. COBRA benefits 2025 stands as a critical federal provision, offering a temporary yet vital bridge for individuals and their families to maintain health insurance after specific qualifying events. Understanding its eligibility requirements, coverage durations, financial implications, and the precise election process is paramount. While COBRA can be a costly option, its role in providing continuity of care, especially for those with ongoing medical needs, cannot be overstated. By thoroughly exploring all available options, including alternatives like the Health Insurance Marketplace, and by making informed, timely decisions, individuals can ensure they secure the best possible healthcare coverage during life’s unpredictable moments.