Maximize Social Security: Claim Strategies for 15% Higher Payout

By understanding and strategically applying claiming ages, spousal benefits, and work history adjustments, individuals can significantly increase their Social Security payouts by up to 15%.

Are you looking to make the most out of your retirement? Understanding how to maximize social security benefits is not just about receiving a check; it’s about optimizing a crucial income stream that can significantly impact your financial well-being for decades. This guide delves into insider knowledge and strategic approaches to help you potentially secure a 15% higher payout, transforming your retirement landscape.

Understanding the Basics of Social Security Benefits

Before diving into advanced strategies, it’s essential to grasp the fundamental principles of Social Security. This federal program provides retirement, disability, and survivor benefits, funded primarily through payroll taxes. Your benefit amount is calculated based on your highest 35 years of earnings, adjusted for inflation.

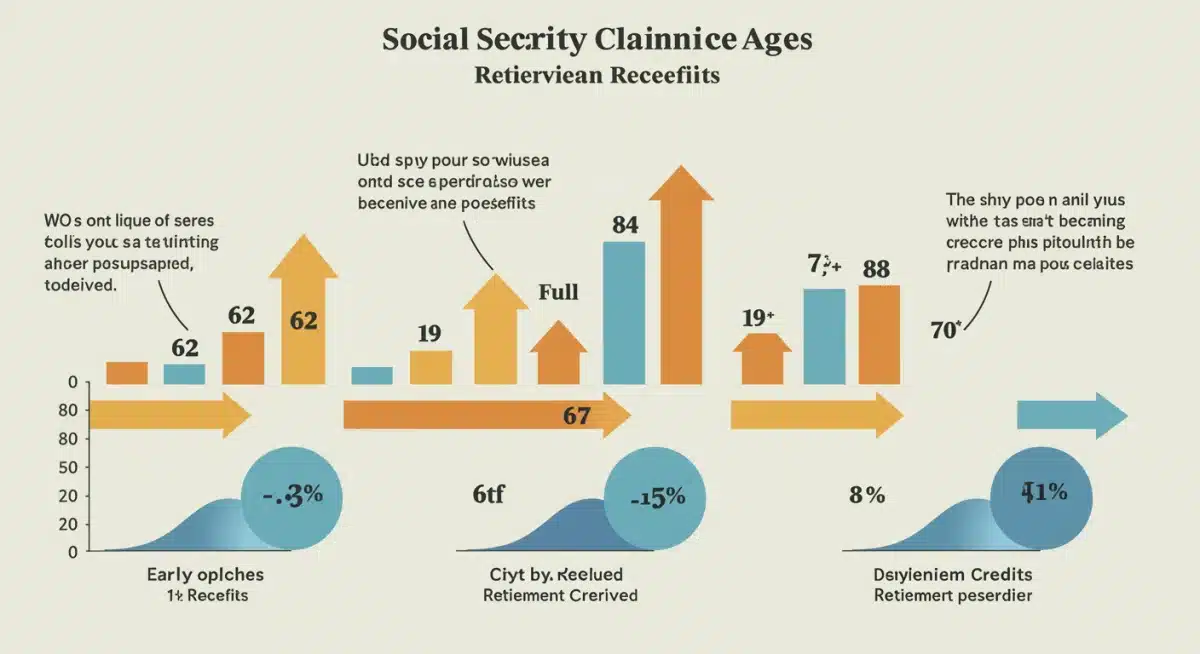

The system is designed with flexibility, allowing individuals to claim benefits as early as age 62, at their full retirement age (FRA), or to delay claiming up to age 70. Each choice has significant financial implications, directly affecting the monthly amount you receive throughout your retirement.

How Your Earnings History Impacts Benefits

Your Social Security benefit is directly tied to your lifetime earnings. The Social Security Administration (SSA) uses a formula that averages your 35 highest-earning years. If you have fewer than 35 years of earnings, zero-earning years will be factored into the average, which can reduce your overall benefit. Therefore, a consistent and strong work history is paramount.

- Consistent Employment: Aim for at least 35 years of substantial earnings.

- High-Earning Years: Focus on maximizing income during your peak earning years.

- Review Your Statement: Regularly check your Social Security statement for accuracy in reported earnings.

Understanding these foundational elements sets the stage for exploring more advanced claiming strategies. It’s not merely about when you claim, but how your entire work life contributes to that ultimate payout.

The Critical Role of Claiming Age: Early vs. Full vs. Delayed

The age at which you begin receiving Social Security benefits is perhaps the single most impactful decision you’ll make regarding your retirement income. There are three primary claiming periods: early retirement (age 62), full retirement age (FRA), and delayed retirement (up to age 70).

Claiming early, at age 62, results in a permanent reduction of your monthly benefit, as you will receive more payments over a longer period. Conversely, delaying benefits past your FRA increases your monthly payment, as you will receive fewer payments over a shorter period.

Calculating Your Full Retirement Age (FRA)

Your Full Retirement Age (FRA) is determined by your birth year. For those born in 1943 through 1954, FRA is 66. It gradually increases for those born between 1955 and 1960, reaching 67 for anyone born in 1960 or later. Knowing your precise FRA is crucial for strategic planning.

- Born 1943-1954: FRA is 66.

- Born 1955: FRA is 66 and 2 months.

- Born 1960 or later: FRA is 67.

Understanding these age brackets is fundamental because claiming at FRA means you receive 100% of your primary insurance amount (PIA). Any deviation from this age will either reduce or increase that amount.

The Power of Delayed Claiming: Earning Delayed Retirement Credits

Delaying your Social Security benefits past your FRA, up to age 70, can result in a significant increase in your monthly payout. For each year you delay past your FRA, your benefit increases by approximately 8% through delayed retirement credits (DRCs). This amounts to a substantial boost over time.

For someone with an FRA of 67, delaying until age 70 means an additional 24% on top of their full benefit. This strategy is particularly attractive for those who are healthy, have other income sources, or simply wish to maximize their guaranteed lifetime income.

For example, if your full retirement benefit at age 67 is $2,000 per month, delaying until age 70 could increase it to $2,480 per month. This 24% increase is locked in for the rest of your life and is also subject to cost-of-living adjustments, making it a powerful tool for enhancing long-term financial security.

Carefully evaluating your health, financial needs, and longevity expectations is key to deciding if delayed claiming is the right path for you. It’s a strategic move that can provide a substantial, lifelong financial advantage.

Strategic Spousal Benefits: Maximizing Household Income

For married couples, Social Security offers a unique opportunity to optimize benefits through spousal claiming strategies. One spouse may be eligible to receive benefits based on the other spouse’s work record, even if they never worked or had lower earnings. This can significantly increase the total household Social Security income.

A spouse can receive up to 50% of the higher-earning spouse’s full retirement age benefit. This is a critical point for couples to understand, as it can often lead to a higher combined payout than if each spouse simply claimed their own benefit independently.

Claiming Spousal Benefits While Deferring Your Own

One powerful strategy, often referred to as ‘file and suspend’ (though largely restricted now), allowed one spouse to file for their benefits at FRA, immediately suspend them, and then allow the other spouse to claim spousal benefits while their own benefits continued to grow. While the original ‘file and suspend’ option has been significantly limited for most, similar principles can still apply.

Today, the strategy often involves one spouse claiming their own benefits at FRA, and the other spouse claiming spousal benefits based on the first spouse’s record. This allows the second spouse’s individual benefit to continue growing with delayed retirement credits until age 70.

- Coordination is Key: Couples must coordinate their claiming ages.

- Higher Earner’s Role: The higher-earning spouse’s decision impacts spousal benefits.

- Benefit Calculation: Spousal benefits are generally 50% of the worker’s full retirement benefit.

This coordinated approach ensures that the household maximizes its total income over the longest possible period. It requires careful planning and an understanding of each spouse’s individual benefit amount and FRA.

Divorced Spouse Benefits: An Often Overlooked Opportunity

Even after divorce, individuals can often claim spousal benefits based on their ex-spouse’s work record, provided certain conditions are met. This is a significant benefit that many eligible individuals overlook, leaving money on the table.

To qualify, the marriage must have lasted at least 10 years, you must be currently unmarried, and you must be at least 62 years old. Your ex-spouse must also be eligible for Social Security benefits, though they do not need to have filed for them yet. Importantly, claiming these benefits does not affect your ex-spouse’s benefit amount or their current spouse’s benefits.

This provision offers a vital safety net and an opportunity for increased income for many divorced individuals. It underscores the complexity and potential for optimization within the Social Security system, highlighting the need for thorough research or professional advice.

Working in Retirement: Impact on Your Benefits

Deciding to work in retirement can have a dual impact on your Social Security benefits. On one hand, continued earnings can increase your overall benefit amount if those years replace lower-earning years in your 35-year average. On the other hand, if you claim benefits before your full retirement age and continue to work, your benefits may be temporarily reduced.

The Social Security Administration has an earnings test that applies if you are under your full retirement age. If your earnings exceed a certain annual limit, a portion of your benefits will be withheld. However, once you reach your FRA, the earnings test no longer applies, and you can earn as much as you want without your benefits being reduced.

Understanding the Earnings Test Limits

For those who claim benefits before their FRA and continue to work, the earnings test is a crucial consideration. In the year you reach FRA, the SSA deducts $1 from your benefits for every $3 you earn above a different, higher limit. For years prior to your FRA, the SSA deducts $1 for every $2 you earn above a specific annual limit.

- Before FRA: Benefits are reduced by $1 for every $2 earned above the annual limit.

- Year of FRA: Benefits are reduced by $1 for every $3 earned above a higher annual limit until the month you reach FRA.

- At or After FRA: No earnings limit; benefits are not reduced.

It’s important to remember that any benefits withheld due to the earnings test are not lost forever. Once you reach your FRA, the SSA recalculates your benefit amount to account for the withheld benefits, potentially increasing your monthly payment for the rest of your life.

How Additional Earnings Can Boost Your 35-Year Average

Even if you are past your FRA and working, those additional earnings can still benefit you. If your current earnings are among your highest 35 years (adjusted for inflation), they will replace a lower-earning year in your record, potentially increasing your primary insurance amount (PIA) and thus your monthly benefit.

This means that continuing to work, even part-time, can be a powerful strategy to incrementally increase your Social Security payout. The SSA automatically recomputes your benefit each year to include any new earnings, ensuring your benefit reflects your most recent and highest earning years.

Therefore, working in retirement isn’t just about supplementing income; it can be a strategic move to permanently enhance your Social Security benefits, particularly if you have gaps in your work history or lower-earning years that can be replaced.

Survivor Benefits: Ensuring Financial Security for Loved Ones

Social Security also provides crucial survivor benefits, offering financial protection to eligible family members upon the death of a worker. These benefits can be a lifeline for widows, widowers, and dependent children, ensuring some level of continued income during a difficult time. Understanding who is eligible and how these benefits are calculated is vital for comprehensive financial planning.

The amount of survivor benefits depends on the deceased worker’s earnings record and the relationship of the survivor to the deceased. Generally, a surviving spouse can receive between 71.5% and 100% of the deceased worker’s basic Social Security benefit, depending on their age and other factors.

Eligibility for Widows and Widowers

Widows and widowers can claim survivor benefits as early as age 60 (or age 50 if disabled). If they wait until their own full retirement age, they can receive 100% of the deceased spouse’s benefit. However, claiming early will result in a reduced benefit.

- Age 60: Eligible for reduced benefits.

- Full Retirement Age: Eligible for 100% of the deceased spouse’s benefit.

- Dependent Children: Also eligible for benefits, up to a family maximum.

It’s important to note that if a surviving spouse remarries before age 60 (or age 50 if disabled), they generally cannot receive benefits as a surviving spouse. However, if they remarry after age 60, they can still receive benefits based on their deceased spouse’s record, or their new spouse’s record, whichever is higher.

Coordinating Survivor Benefits with Your Own

A unique aspect of survivor benefits is the ability to switch between claiming your own benefit and a survivor benefit. For example, a widow or widower who is eligible for both a survivor benefit and their own retirement benefit can choose to take one benefit first and switch to the other later, if it results in a higher payment.

This strategy allows for significant optimization. For instance, a widow might claim a reduced survivor benefit at age 60, allowing their own retirement benefit to continue growing with delayed retirement credits until age 70, at which point they would switch to their own higher benefit. This requires careful analysis of both benefit amounts and ages.

The flexibility in claiming survivor benefits provides a powerful tool for financial security, allowing individuals to adapt to changing life circumstances and maximize their overall Social Security income.

Navigating Social Security Taxation and Cost-of-Living Adjustments (COLAs)

While Social Security benefits provide a vital income stream, it’s important to understand that a portion of these benefits may be subject to federal income tax. Additionally, the annual cost-of-living adjustment (COLA) plays a significant role in maintaining the purchasing power of your benefits over time.

The taxation of Social Security benefits depends on your ‘combined income,’ which includes your adjusted gross income, tax-exempt interest, and half of your Social Security benefits. For many retirees, understanding these tax implications is crucial for accurate financial planning.

When Your Social Security Benefits Are Taxable

If your combined income is between $25,000 and $34,000 for an individual, or between $32,000 and $44,000 for a couple filing jointly, up to 50% of your Social Security benefits may be taxable. If your combined income exceeds these higher thresholds, up to 85% of your benefits may be subject to federal income tax.

- Individual Threshold: $25,000 – $34,000 (up to 50% taxable).

- Joint Threshold: $32,000 – $44,000 (up to 50% taxable).

- Higher Incomes: Above these, up to 85% of benefits are taxable.

States also have varying rules regarding the taxation of Social Security benefits. Some states tax benefits, while others do not. It’s essential to research your state’s specific regulations to get a complete picture of your tax liability.

The Importance of Cost-of-Living Adjustments (COLAs)

Cost-of-Living Adjustments (COLAs) are annual increases to Social Security and Supplemental Security Income (SSI) benefits. These adjustments are designed to help benefits keep pace with inflation, ensuring that retirees’ purchasing power is not eroded over time. COLAs are determined by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

While COLAs are not guaranteed to be substantial every year, they are a critical component of Social Security’s value proposition. A higher initial benefit, achieved through strategic claiming, will result in larger COLA increases in dollar terms over the years, further amplifying the benefits of smart planning.

Understanding both the tax implications and the protective nature of COLAs allows for more accurate long-term financial projections, ensuring that your maximized Social Security benefits truly serve your retirement needs.

Expert Tips and Common Pitfalls to Avoid

Navigating the complexities of Social Security can be challenging, but armed with the right knowledge, you can avoid common mistakes and make informed decisions. Many individuals inadvertently leave money on the table due to a lack of understanding or by making hasty claiming choices.

One of the biggest pitfalls is claiming benefits too early without fully understanding the long-term impact on monthly payouts. While immediate cash flow might seem appealing, the permanent reduction in benefits can be significant over a lifetime, especially for those with longer life expectancies.

Seeking Professional Advice

Given the individualized nature of Social Security planning, seeking advice from a qualified financial advisor specializing in retirement planning can be invaluable. An expert can analyze your unique financial situation, health status, and family circumstances to recommend the optimal claiming strategy.

- Personalized Strategy: An advisor can tailor a plan to your specific needs.

- Complex Scenarios: They can help navigate intricate situations like divorced spousal benefits or coordinating with other retirement accounts.

- Stay Updated: Advisors are abreast of changes in Social Security rules and regulations.

Their expertise can help you identify opportunities for increased payouts that you might otherwise miss, ensuring you make the most informed decision possible.

Regularly Reviewing Your Social Security Statement

Your annual Social Security statement is a crucial document. It provides an estimate of your future benefits, based on your earnings record, and details your reported earnings history. Regularly reviewing this statement is essential to ensure its accuracy.

Errors in your earnings record can significantly impact your future benefits. If you find any discrepancies, it’s vital to contact the SSA immediately to rectify them. Proactive monitoring of your statement is a simple yet powerful way to protect your future Social Security income.

By staying informed, seeking expert guidance, and diligently reviewing your records, you can confidently navigate the Social Security system and ensure you are maximizing your benefits for a more secure and comfortable retirement.

| Key Strategy | Brief Description |

|---|---|

| Delayed Claiming | Delaying benefits past Full Retirement Age (FRA) up to age 70 earns 8% annual delayed retirement credits. |

| Spousal Benefits | Married or divorced individuals may claim up to 50% of a spouse’s or ex-spouse’s benefit. |

| Work History Optimization | Ensure 35 years of high earnings; current work can replace lower-earning years, increasing PIA. |

| Survivor Benefit Coordination | Eligible widows/widowers can strategically claim one benefit and switch to a higher one later. |

Frequently Asked Questions About Social Security Benefits

The ideal age depends on individual circumstances. Claiming at Full Retirement Age (FRA) provides 100% of your benefit. Delaying until age 70 offers the highest monthly payout due to delayed retirement credits, while claiming at 62 results in a permanent reduction. Consider health, financial needs, and longevity.

Yes, if you claim benefits before your Full Retirement Age (FRA), your benefits may be reduced if your earnings exceed annual limits. Once you reach FRA, there are no earnings limits, and benefits are not reduced. Continued work can also increase your benefit if it replaces lower-earning years.

A spouse can receive up to 50% of their partner’s Full Retirement Age benefit. Couples can strategically coordinate claiming ages, potentially allowing one spouse to claim spousal benefits while their own individual benefit continues to grow with delayed retirement credits until age 70.

Yes, if the marriage lasted at least 10 years, you are currently unmarried, and are at least 62. Your ex-spouse must be eligible for benefits. Claiming these benefits does not affect your ex-spouse’s benefit or their current spouse’s benefits.

A portion of your Social Security benefits may be subject to federal income tax depending on your ‘combined income.’ If your combined income exceeds certain thresholds, up to 85% of your benefits could be taxable. State tax rules also vary.

Conclusion

Maximizing your Social Security benefits is more than just a financial decision; it’s a strategic pathway to a more secure and comfortable retirement. By understanding the nuances of claiming ages, leveraging spousal and survivor benefits, optimizing your work history, and staying informed about tax implications and COLAs, you can significantly increase your lifetime payout. The difference between an average approach and a strategic one can truly amount to a 15% or higher increase, providing a substantial boost to your financial well-being. Proactive planning and, if necessary, professional guidance are your best allies in navigating this complex yet rewarding system.