Unlock Your 2026 DCFSA Savings: 20% Off Childcare Costs

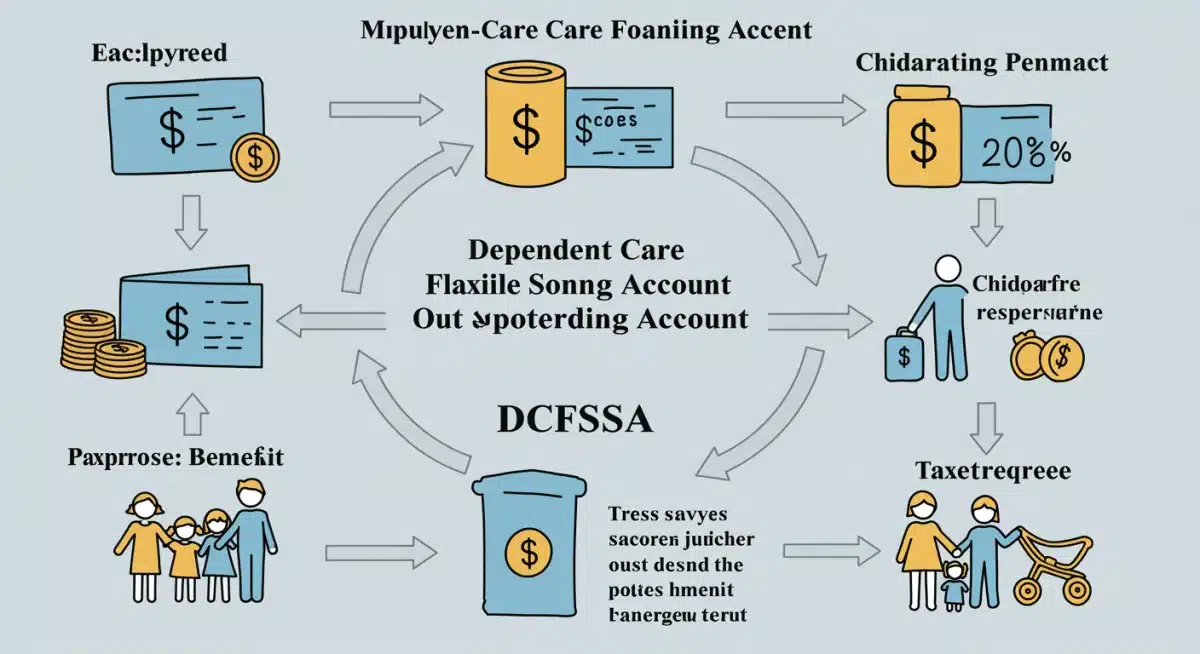

Unlocking Your 2026 Dependent Care Flexible Spending Account (DCFSA): Insider Tips to Save 20% on Childcare Costs is a crucial strategy for families to reduce their financial burden by utilizing pre-tax dollars for eligible expenses.

For many working families, childcare expenses represent a significant portion of their annual budget. The opportunity to save substantially on these costs is invaluable. Through Unlocking Your 2026 Dependent Care Flexible Spending Account (DCFSA): Insider Tips to Save 20% on Childcare Costs, you can strategically reduce your financial burden and gain peace of mind. This article will guide you through maximizing this powerful benefit.

Understanding the 2026 Dependent Care Flexible Spending Account (DCFSA)

The Dependent Care Flexible Spending Account (DCFSA) is a pre-tax benefit offered by employers that allows employees to set aside money to pay for eligible dependent care expenses. This means the money you contribute to a DCFSA is not subject to federal income tax, Social Security, or Medicare taxes, which can lead to significant savings. For 2026, understanding the nuances of this account is paramount for effective financial planning.

The primary appeal of a DCFSA lies in its tax advantages. By using pre-tax dollars, you effectively lower your taxable income, translating into direct savings on your tax bill. This benefit is designed to support working parents or guardians who incur childcare costs necessary for them to work or look for work.

Who is eligible for a DCFSA?

Eligibility for a DCFSA typically depends on your employment status and the nature of your dependent care expenses. Generally, you must be employed by a company that offers a DCFSA, and your dependent must meet specific criteria. This often includes children under the age of 13, or a spouse or other dependent who is physically or mentally incapable of self-care and lives with you for more than half the year.

- Must be a working individual or actively seeking employment.

- Dependent must be under 13 or an incapacitated spouse/dependent.

- Expenses must be work-related, enabling you to earn income.

- Both spouses must be working, looking for work, or one is a full-time student/incapacitated.

It’s important to note that if you are married, both you and your spouse must be working, looking for work, or one spouse must be a full-time student or physically/mentally incapable of self-care. This ensures the dependent care expenses are genuinely incurred to allow you to maintain employment.

Maximizing Your DCFSA Contributions for 2026

The amount you can contribute to a DCFSA is subject to annual limits set by the IRS. For 2026, it is crucial to be aware of these limits to ensure you are maximizing your savings without overcontributing. These limits are designed to provide substantial relief while preventing misuse of the tax-advantaged account.

The typical maximum contribution for a DCFSA is $5,000 per household per year if you are married filing jointly or a single filer, or $2,500 if you are married filing separately. These figures are subject to slight adjustments annually, so confirming the exact 2026 limits is a key first step. Contributing the maximum allowable amount is often the most effective way to leverage the tax savings.

Understanding the “Use-It-or-Lose-It” Rule

One of the most critical aspects of a DCFSA is the “use-it-or-lose-it” rule. Unlike some other flexible spending accounts, DCFSAs typically require you to spend all the money in your account by the end of the plan year, or you forfeit the remaining balance. This rule emphasizes the importance of careful planning and accurate expense estimation.

- Funds must be spent within the plan year.

- No carryover of unspent funds to the next year.

- Some plans may offer a grace period (2.5 months) or a small carryover.

- Careful estimation of future childcare costs is essential.

To avoid losing funds, it’s advisable to estimate your childcare expenses conservatively. Review your past year’s spending, consider any upcoming changes in childcare needs, and factor in potential rate increases. Many employers offer tools or calculators to help you project your expenses more accurately, aiding in making informed contribution decisions.

Eligible Childcare Expenses for DCFSA in 2026

Knowing which expenses qualify for reimbursement through your DCFSA is fundamental to fully utilizing the benefit. The IRS has specific guidelines on what constitutes an eligible dependent care expense. These expenses must be incurred for the care of a qualifying dependent to enable you (and your spouse, if married) to work or look for work.

Common eligible expenses include fees for daycare centers, preschool, after-school programs, and summer day camps. It also covers payments to nannies, au pairs, and babysitters, provided they are not your child or a dependent. Understanding these categories is crucial for effective reimbursement and maximizing your savings.

What generally qualifies?

The range of eligible expenses is broad, but always tied to the core purpose: allowing you to work. This means expenses like overnight camps, private school tuition (beyond care components), or medical care are typically not covered. Focus on services primarily for the well-being and supervision of your dependent.

- Daycare and nursery school fees.

- After-school care programs.

- Summer day camps (not overnight).

- Nanny, au pair, or babysitter wages (if not a dependent).

- Costs for care provided in your home or another’s home.

It’s vital to keep meticulous records of all your dependent care expenses, including receipts and statements from providers. These documents will be necessary when submitting claims for reimbursement and can be requested by the IRS if your account is audited. Ensuring your providers are legitimate and report their income correctly is also important.

Strategic Planning and Enrollment Tips for 2026

Enrollment in a DCFSA typically occurs during your employer’s open enrollment period. This is your annual opportunity to elect or change your contribution amount for the upcoming plan year. Strategic planning during this period can significantly impact your potential savings and avoid pitfalls associated with the “use-it-or-lose-it” rule.

Before open enrollment, take time to project your childcare needs and associated costs for the entire 2026 calendar year. Consider any changes in your work schedule, your child’s age, or potential shifts in childcare providers. A thorough projection will help you determine an accurate contribution amount, preventing both underfunding and overfunding your account.

Key considerations for enrollment

When enrolling, ensure you have all necessary information about your dependents and care providers. Some employers may require provider information upfront, though typically it’s needed for reimbursement. Also, understand your employer’s specific plan rules, as some may offer a grace period or limited carryover, which can provide a small buffer against the “use-it-or-lose-it” rule.

- Review previous year’s childcare expenses.

- Anticipate changes: new school, provider, or work hours.

- Confirm 2026 IRS contribution limits and employer rules.

- Understand the claims process and required documentation.

Don’t hesitate to consult with your HR department or benefits administrator if you have questions about your company’s specific DCFSA plan. They can provide clarity on eligible expenses, submission deadlines, and any unique features of your plan. Proactive engagement ensures you make the most informed decisions during open enrollment.

Comparing DCFSA with the Child and Dependent Care Credit

While the DCFSA offers significant tax advantages, it’s not the only way to save on childcare costs. The federal Child and Dependent Care Credit (CDCC) is another valuable benefit that families can consider. Understanding the differences and how they interact is crucial, as you generally cannot claim both for the same expenses.

The DCFSA allows you to use pre-tax dollars, reducing your taxable income upfront. The CDCC, on the other hand, is a tax credit that directly reduces your tax liability after your income has been calculated. For many families, one option provides greater savings than the other, depending on their income level and total childcare expenses.

Which option is better for your family?

Deciding between a DCFSA and the CDCC often comes down to an analysis of your marginal tax bracket and the total amount of your eligible expenses. Families in higher tax brackets often find the DCFSA more beneficial because its pre-tax nature provides a greater percentage of savings. The CDCC tends to favor lower and middle-income families.

- DCFSA offers pre-tax savings, reducing taxable income.

- CDCC is a tax credit, directly reducing tax liability.

- Cannot use both for the same expenses; choose one for maximum benefit.

- Consult a tax professional for personalized advice based on your income.

It’s possible to use both benefits if your childcare expenses exceed the DCFSA contribution limit. You can use your DCFSA for up to $5,000 of expenses and then claim the CDCC for any remaining eligible expenses, up to the CDCC’s maximum limits. However, the expenses covered by the DCFSA cannot be used again for the CDCC. Always consult with a tax professional to determine the most advantageous strategy for your specific financial situation in 2026.

Common Pitfalls and How to Avoid Them

While a DCFSA is a powerful tool for savings, there are common mistakes that participants make, leading to forfeited funds or missed opportunities. Being aware of these pitfalls can help you navigate the system more effectively and ensure you reap the full benefits of your contributions.

One of the most frequent errors is miscalculating expenses, leading to unspent funds at the end of the year. Another common issue is not submitting claims in a timely manner or failing to maintain proper documentation. These seemingly small oversights can result in significant financial losses. Proper planning and organization are key to avoiding these problems.

Avoiding the “use-it-or-lose-it” trap

The “use-it-or-lose-it” rule is the most significant challenge for many DCFSA participants. To mitigate this risk, regularly review your account balance and compare it against your remaining eligible expenses. If you find yourself with an excess balance late in the plan year, consider prepaying for eligible services if your plan allows, or scheduling additional care if needed and feasible.

- Estimate expenses carefully and review them quarterly.

- Submit claims promptly with all required documentation.

- Understand your plan’s grace period or carryover rules.

- Don’t confuse DCFSA with a Healthcare FSA (HCFSA).

Another pitfall is confusing eligible expenses. For instance, while summer day camps qualify, overnight camps typically do not. Always double-check the IRS guidelines and your plan’s specific rules before incurring an expense you intend to claim. Maintaining clear communication with your childcare provider about their billing practices can also prevent issues when submitting claims.

Future Outlook and Trends for DCFSA in 2026

The landscape of employee benefits, including DCFSAs, is continually evolving, influenced by economic conditions, legislative changes, and employer priorities. For 2026, while the core structure of the DCFSA is expected to remain consistent, there might be subtle shifts in contribution limits, eligible expenses, or employer-specific plan designs. Staying informed is crucial for maximizing benefits.

Historically, there has been a push for greater flexibility and expanded definitions of dependent care. While major overhauls are less common, incremental adjustments are always possible. Employers are also increasingly looking for ways to enhance their benefits packages to attract and retain talent, which could lead to more robust DCFSA offerings or better integration with other family-friendly policies.

Anticipating changes and staying informed

One trend to watch is the potential for increased automation and digital tools to manage DCFSAs. Many plan administrators are investing in user-friendly portals and mobile apps that make submitting claims, tracking balances, and understanding eligibility easier. These technological advancements can simplify the process for employees and reduce the administrative burden.

- Monitor IRS announcements for updated contribution limits.

- Review employer benefit communications for plan changes.

- Engage with HR or benefits providers for clarity on new features.

- Consider how broader economic trends might impact childcare costs.

Furthermore, discussions around broader childcare reform at the federal level could indirectly influence the DCFSA. While direct changes might not occur annually, any significant legislative shifts in childcare support could alter the comparative advantage of a DCFSA versus other programs. Remain vigilant for official announcements from the IRS and your employer regarding any updates to the DCFSA for 2026.

| Key Aspect | Brief Description |

|---|---|

| Tax Savings | Utilize pre-tax dollars for eligible childcare, reducing your taxable income and saving on federal, Social Security, and Medicare taxes. |

| Contribution Limits | Typically $5,000 per household ($2,500 for married filing separately) for 2026, verify current IRS limits. |

| Eligible Expenses | Covers daycare, preschool, after-school care, and nannies for children under 13, enabling work or job search. |

| “Use-It-or-Lose-It” | Funds must be spent within the plan year or a grace period; careful planning is essential to avoid forfeiture. |

Frequently Asked Questions about DCFSA 2026

The main benefit of a DCFSA is the ability to pay for eligible dependent care expenses with pre-tax dollars. This reduces your taxable income, leading to significant savings on federal income tax, Social Security, and Medicare taxes, effectively lowering your overall childcare costs by up to 20% or more, depending on your tax bracket.

No, DCFSA funds can only be used for specific eligible expenses. These typically include costs for daycare, preschool, after-school care, and summer day camps for children under 13. The expenses must be necessary for you (and your spouse, if applicable) to work or look for work. Overnight camps or private school tuition generally do not qualify.

Due to the “use-it-or-lose-it” rule, any unspent funds in your DCFSA at the end of the plan year are typically forfeited. Some employers may offer a grace period (up to 2.5 months into the next year) or a small carryover amount, but this is not universal. Careful planning and expense estimation are crucial to avoid losing funds.

The better option depends on your specific financial situation. DCFSA offers pre-tax savings, reducing your taxable income, which is often more beneficial for higher-income earners. The Child and Dependent Care Credit is a tax credit that directly reduces your tax liability, often favoring lower to middle-income families. You generally cannot use both for the same expenses.

Enrollment typically occurs during your employer’s annual open enrollment period. You will need to elect your contribution amount for the upcoming plan year. It’s essential to estimate your childcare expenses accurately and understand your employer’s specific plan rules. Contact your HR department or benefits administrator for details on your company’s enrollment process.

Conclusion

Unlocking Your 2026 Dependent Care Flexible Spending Account (DCFSA): Insider Tips to Save 20% on Childcare Costs presents a powerful financial strategy for working families. By meticulously planning your contributions, understanding eligible expenses, and being mindful of the “use-it-or-lose-it” rule, you can significantly reduce your tax burden and free up valuable funds. While careful consideration is needed, the DCFSA remains an indispensable tool for managing childcare costs, offering substantial relief and enabling greater financial stability for parents across the United States.